The Ultimate Options Trading Crash Course: Strategies for Success in Forex and Stocks

Options trading is a powerful way to speculate on the future movement of assets like stocks and currencies. By understanding how options work and how to use them effectively, you can potentially generate high returns with limited risk.

This crash course will teach you everything you need to know about options trading, from the basics to advanced strategies. We'll cover topics such as:

- What are options and how do they work?

- The different types of options and their uses

- How to price options and calculate potential profits and losses

- Risk management strategies for options trading

- Common options trading strategies

- How to trade options in forex and stocks

An option is a contract that gives the buyer the right, but not the obligation, to buy or sell an asset at a specified price on or before a specified date. The seller of the option is obligated to fulfill the contract if the buyer exercises their right.

4.7 out of 5

| Language | : | English |

| File size | : | 2491 KB |

| Text-to-Speech | : | Enabled |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 461 pages |

| Lending | : | Enabled |

| Screen Reader | : | Supported |

There are two main types of options: calls and puts. A call option gives the buyer the right to buy an asset at a specified price on or before a specified date. A put option gives the buyer the right to sell an asset at a specified price on or before a specified date.

The price at which the buyer can buy or sell the asset is called the strike price. The date on which the option expires is called the expiration date.

There are many different types of options, each with its own unique uses. Some of the most common types of options include:

- Call options: Give the buyer the right to buy an asset at a specified price on or before a specified date. Call options are typically used when the buyer believes that the price of the asset will rise.

- Put options: Give the buyer the right to sell an asset at a specified price on or before a specified date. Put options are typically used when the buyer believes that the price of the asset will fall.

- Covered calls: A type of call option in which the seller owns the underlying asset. Covered calls are typically used to generate income from an existing position.

- Naked calls: A type of call option in which the seller does not own the underlying asset. Naked calls are more risky than covered calls, but they can also be more profitable.

- Married puts: A type of put option in which the seller also owns a call option with the same strike price and expiration date. Married puts are typically used to protect an existing position from downside risk.

The price of an option is determined by a number of factors, including the price of the underlying asset, the strike price, the expiration date, and the volatility of the underlying asset.

The potential profit or loss on an option trade is determined by the difference between the price at which the option is purchased or sold and the price at which the underlying asset is purchased or sold.

Options trading can be a risky endeavor, but there are a number of strategies that can be used to manage risk. Some of the most common risk management strategies for options trading include:

- Setting stop-loss orders: A stop-loss order is an order to sell an option if the price of the underlying asset falls below a certain level. Stop-loss orders can help to limit losses if the market moves against you.

- Using margin cautiously: Margin is a type of loan that can be used to increase your buying power. However, using margin can also increase your risk of loss. It is important to use margin cautiously and to only borrow as much as you can afford to lose.

- Trading with small position sizes: One of the best ways to manage risk is to trade with small position sizes. This will limit your potential losses if the market moves against you.

There are many different options trading strategies that can be used to generate profits. Some of the most common options trading strategies include:

- Buying calls: Buying a call option gives you the right to buy an asset at a specified price on or before a specified date. This strategy is typically used when you believe that the price of the asset will rise.

- Selling calls: Selling a call option gives you the obligation to sell an asset at a specified price on or before a specified date. This strategy is typically used when you believe that the price of the asset will fall.

- Buying puts: Buying a put option gives you the right to sell an asset at a specified price on or before a specified date. This strategy is typically used when you believe that the price of the asset will fall.

- Selling puts: Selling a put option gives you the obligation to buy an asset at a specified price on or before a specified date. This strategy is typically used when you believe that the price of the asset will rise.

- Using spreads: A spread is a strategy that involves buying and selling two or more options with different strike prices and/or expiration dates. Spreads can be used to create a variety of different payoffs, depending on how the prices of the underlying assets move.

Options can be traded on a variety of underlying assets, including stocks, currencies, and commodities. The process of trading options is similar across all asset classes.

To trade options, you will need to open an account with a broker that offers options trading. Once you have opened an account, you can use a trading platform to place your orders.

When you place an order to buy or sell an option, you will need to specify the following information:

- The type of option you are trading (call or put)

- The underlying asset

- The strike price

- The expiration date

- The number of options you want to buy or sell

Once you have placed your order, the broker will execute the trade for you. You will then be responsible for managing the position until it expires or is closed.

Options trading can be a powerful

4.7 out of 5

| Language | : | English |

| File size | : | 2491 KB |

| Text-to-Speech | : | Enabled |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 461 pages |

| Lending | : | Enabled |

| Screen Reader | : | Supported |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Paperback

Paperback Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Foreword

Foreword Preface

Preface Footnote

Footnote Codex

Codex Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Narrator

Narrator Character

Character Catalog

Catalog Archives

Archives Periodicals

Periodicals Study

Study Research

Research Scholarly

Scholarly Lending

Lending Reserve

Reserve Journals

Journals Interlibrary

Interlibrary Literacy

Literacy Reading List

Reading List Theory

Theory Textbooks

Textbooks Steven Borne

Steven Borne Fabio Meneghini

Fabio Meneghini Ken Warner

Ken Warner Kristin Henning

Kristin Henning Randy Seiver

Randy Seiver Robert Philip

Robert Philip Domenico Luigi Pardini

Domenico Luigi Pardini Masashi Sugiyama

Masashi Sugiyama Louis S Rehr

Louis S Rehr C Fred Alford

C Fred Alford Nicholas Deiuliis

Nicholas Deiuliis Sassafras Lowrey

Sassafras Lowrey Helen Prejean

Helen Prejean Charles Bukowski

Charles Bukowski Sikander Sultan

Sikander Sultan Kadija Phillips

Kadija Phillips Tara C Steele

Tara C Steele Shani T Night

Shani T Night Cindy Nichols

Cindy Nichols John Walsh

John Walsh

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Fletcher MitchellThe House Swap Nantucket Breeze: A Tranquil Oasis on the Enchanting Shores of...

Fletcher MitchellThe House Swap Nantucket Breeze: A Tranquil Oasis on the Enchanting Shores of... Graham BlairFollow ·10.6k

Graham BlairFollow ·10.6k Ervin BellFollow ·8.5k

Ervin BellFollow ·8.5k Allen ParkerFollow ·11.9k

Allen ParkerFollow ·11.9k Jarrett BlairFollow ·5.5k

Jarrett BlairFollow ·5.5k Terry BellFollow ·18.5k

Terry BellFollow ·18.5k Heath PowellFollow ·8.4k

Heath PowellFollow ·8.4k Scott ParkerFollow ·2.4k

Scott ParkerFollow ·2.4k Hayden MitchellFollow ·7.2k

Hayden MitchellFollow ·7.2k

E.E. Cummings

E.E. CummingsThe Routledge International Handbook on Fear of Crime

Fear of crime is a serious problem that can...

Fletcher Mitchell

Fletcher MitchellThe Hunchback in Hellenistic and Roman Art: A...

The hunchback, or kyphosis, is a physical...

Victor Turner

Victor TurnerA Comprehensive Guide to Needle Felting for Moms:...

Needle felting, a captivating craft...

Joseph Foster

Joseph FosterWhere is Scandinavia?

Scandinavia is a region in...

Leon Foster

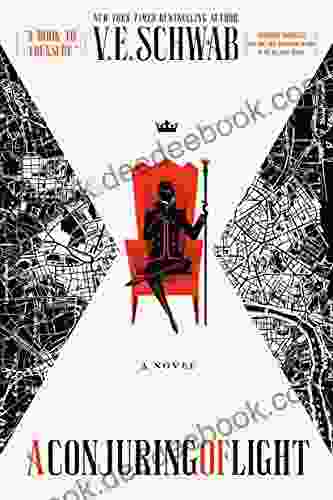

Leon FosterNovel Shades of Magic: A Masterpiece of Magical...

An Enthralling...

4.7 out of 5

| Language | : | English |

| File size | : | 2491 KB |

| Text-to-Speech | : | Enabled |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 461 pages |

| Lending | : | Enabled |

| Screen Reader | : | Supported |